Managing Business & Environmental Risk in the COVID-19 Era

Langan partners with RTM Communications to deliver first-hand business insights.

On June 4 and 11, 2020, Langan and RTM Communications (RTM) delivered two webinars to over 200 attendees on private and public sector challenges in today’s COVID-19 environment. The programs were co-moderated by Rory Johnston, Principal at Langan and Jeffery Telego, President of RTM, while Mimi Raygorodetsky, Senior Associate at Langan moderated the questions asked by attendees.

In the first program, three experts shared their insights about keeping projects moving through innovation in business and remediation technology, coupled with acquisition, site cleanup, and redevelopment strategies. In the second program, attendees heard from our economic, diligence, and public/private financial panel on important trends and opportunities on a macroeconomic and transactional basis.

Keeping Projects Moving

Our speakers for this session included:

Jim Schaeffer, Health Safety Security and Environmental M&A Project Manager, BP

Erik Zitek, Director of Investments, Viridian Partners

John Simon, Editor-In-Chief, Remediation Journal

Moderator Jeff Telego of RTM set the stage acknowledging the short- and potential long-term effects of COVID-19 on the business world and uncertainties with predictions on economic recovery. Telego acknowledged that, regardless of which sectors recover first, environmental risks impact transactions. The fundamentals of good diligence, technical and regulatory expertise to assess remedial alternatives, and well-structured deals remain essential to bracketing and managing risk.

Moderator Jeff Telego of RTM set the stage acknowledging the short- and potential long-term effects of COVID-19 on the business world and uncertainties with predictions on economic recovery. Telego acknowledged that, regardless of which sectors recover first, environmental risks impact transactions. The fundamentals of good diligence, technical and regulatory expertise to assess remedial alternatives, and well-structured deals remain essential to bracketing and managing risk.

Jim Schaeffer spoke of organizational changes at BP, impacts of the decrease in oil prices, and BP’s ambitions to become a greener company. In February of this year, BP CEO Bernard Looney announced that the company would become a net zero company by 2050. Schaeffer said that operating assets will continue to be sold and there will be ongoing opportunities to support transactions and environmental remediation at BP.

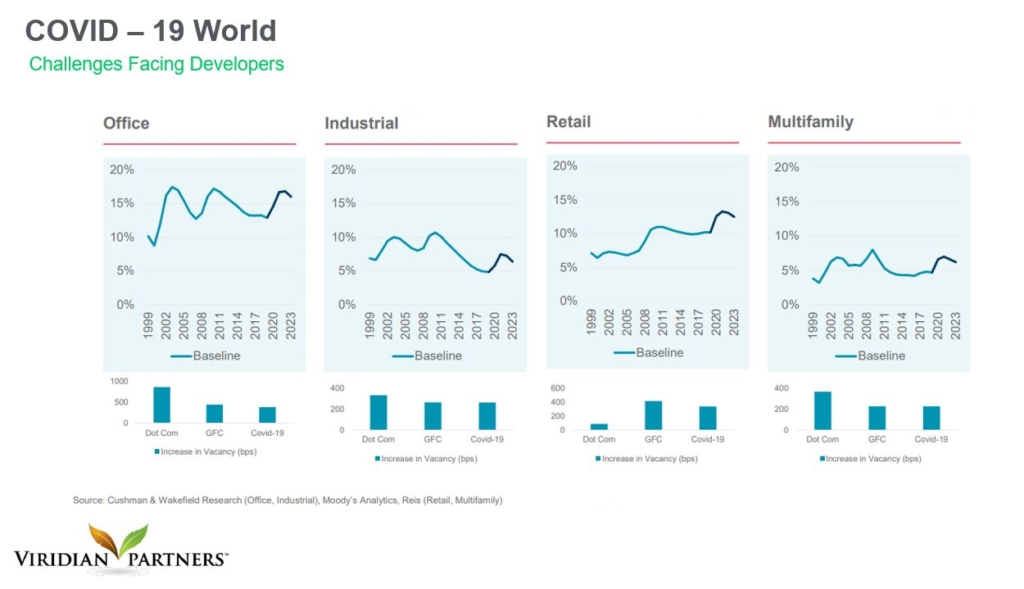

Erik Zitek’s firm, Viridian Partners, does not shy away from environmental risks. When Viridian enters into a deal, they typically assume environmental cleanup. He reported that it has been challenging to complete entitlements due to agencies shutting down. Looking ahead, they are expecting a U-shaped recovery if examples from China, South Korea, and Taiwan are comparable. There is still active capital, but it’s not as aggressive as pre-COVID and so far Viridian has not seen distressed assets hitting the market.

John Simon reported that robust regulatory programs have continued to drive environmental work in many states. He provided a spotlight on some interesting technologies used for data collection as well as use of drones for monitoring workplace density and infrared cleaning options to address COVID-19 transmission concerns.

Economic and Financial Outlook

Our speakers for this session included:

Barry Knapp, Managing Partner, Ironsides Macroeconomics

Eric Rothenberg, Esq., Senior Environmental Partner, O’Melveny & Myers

Matt Ward, Co-Founder and CEO, Sustainable Strategies DC

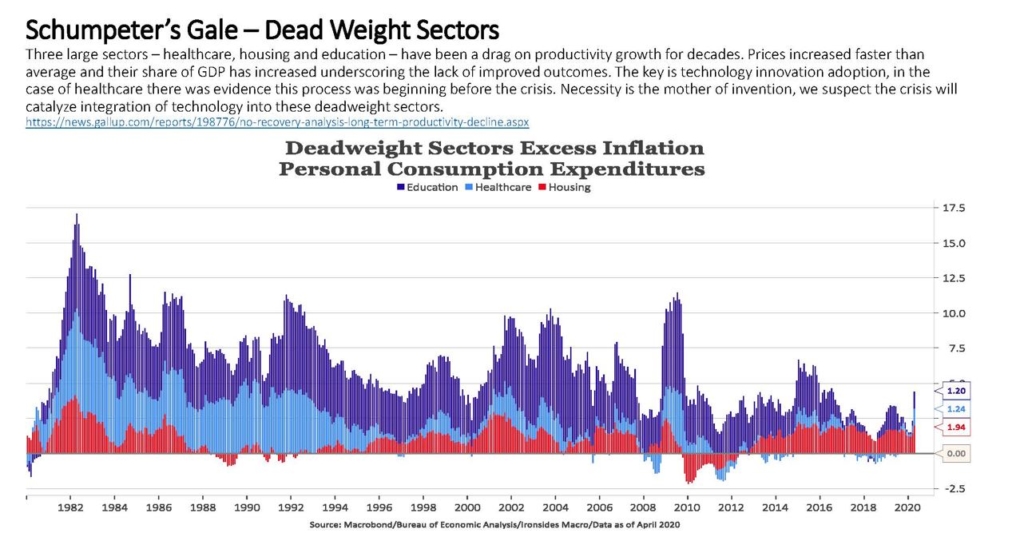

Jeff Telego provided opening comments highlighting the conflicting and diverse perspectives that characterize the current business and economic climate. Barry Knapp’s presentation, “Schumpeter’s Gale: It’s Never Different This Time,” expounded on the basics of this concept with a generally optimistic view that in response to the pandemic, new markets and new services will prompt growth. Knapp pointed out that this has already been seen in the technology sector. He also cited anticipated changes in the future supply chain as companies seek operations that do not rely on global interaction. Regarding impacts to specific markets, he pointed to likely accelerated decreasing sales at brick and mortar retail businesses as consumers rely more on internet retail. Knapp also predicted that healthcare, housing, and education will likely see increased productivity and growth in response to market pressures.

Jeff Telego provided opening comments highlighting the conflicting and diverse perspectives that characterize the current business and economic climate. Barry Knapp’s presentation, “Schumpeter’s Gale: It’s Never Different This Time,” expounded on the basics of this concept with a generally optimistic view that in response to the pandemic, new markets and new services will prompt growth. Knapp pointed out that this has already been seen in the technology sector. He also cited anticipated changes in the future supply chain as companies seek operations that do not rely on global interaction. Regarding impacts to specific markets, he pointed to likely accelerated decreasing sales at brick and mortar retail businesses as consumers rely more on internet retail. Knapp also predicted that healthcare, housing, and education will likely see increased productivity and growth in response to market pressures.

Following Knapp was Eric Rothenberg who presented his insights on the role of private equity, types of transactions, the key firms driving the private equity market, and the status of the capital markets post-COVID.

Rothenberg articulated the types of transaction formats currently being deployed by private equity firms, including direct loan to own, hybrid investments, PIPE investment, and Chapter 11 363 sales and prepacks. He also identified substantial players, including Blackstone Group, KKR, Carlyle Group, Silver Lake, and Apollo, among others.

Furthermore, Rothenberg identified how COVID-19 reshaped the M&A of distressed assets or divestiture of operating assets and surplus properties, specifically focusing on e-Commerce, utilities, healthcare, and energy. He reported that more contaminated assets were coming under private ownership with a demand for warehouses and intermodal, logistics, e-Commerce, cell towers, and re-purposing of office and retail space.

Matt Ward rounded out the presentations with a look at reinvestment and resilience in a post-COVID America. Ward’s presentation addressed the challenges in American communities, ranging from the practical realities of conducting business virtually, viability challenges for small business, retail, hospitality, and many other key sectors, state and local government fiscal stress, fundamental questions about equity and inclusion and under-investment in infrastructure. In the face of these challenges, however, Ward pointed out that there are numerous opportunities including the CARES Act and recent congressional packages, brownfield and land revitalization resources, Opportunity Zones, infrastructure packages, and innovation and entrepreneurship. He concluded by recommending that communities develop a “Resource Roadmap” and that he is hopeful there will be infrastructure investment that drives opportunity for smart growth coupled with renewed focus on green energy, climate resilience, equity, and inclusion.

Langan is committed to providing educational forums for our clients and partners. Thank you to our presenters and attendees. Nicholas DeRose, Senior Consultant and Charlene Drake, Associate at Langan contributed to this summary.